Revenue and Tax

When you start your first job, you should tell Revenue as soon as possible, or you may have to pay Emergency Tax. A Revenue Payroll Notification (RPN) will be sent to TTEC by Revenue. The RPN will tell TTEC how much Income Tax (IT) and Universal Social Charge (USC) to deduct from your pay.

Register for Income Tax

When you start working for the first time, you must register yourself as soon as possible. This is to avoid paying emergency tax. You must do this even if it is a part-time or temporary job.

To do this, you must:

- Apply for your Personal Public Service Number (PPSN), if you do not already have one. This is available from the Department of Social Protection (DSP).

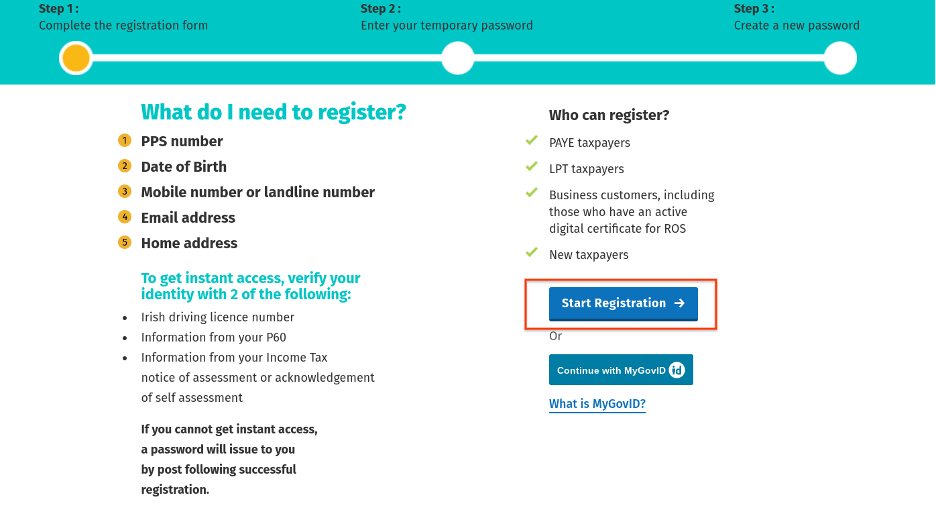

- First time employees should register for myAccount. MyAccount is a single online access point for Revenue services.

Register your new job

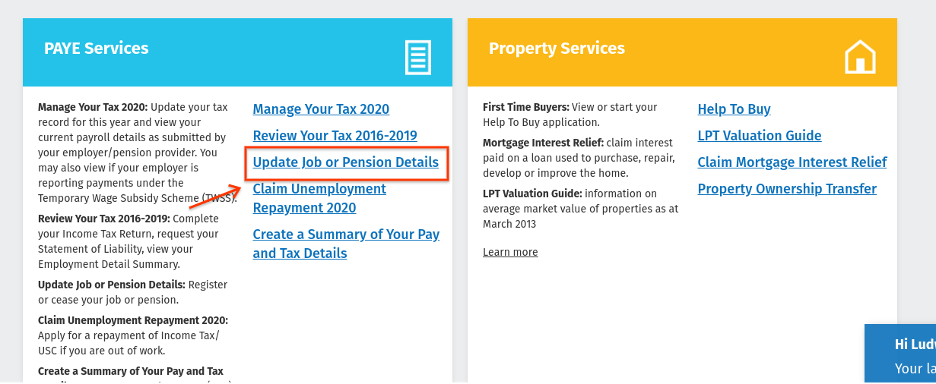

When you receive your myAccount password, you will be able to register your new job. To register, click on the ‘Update job or pension details’ link in ‘PAYE Services’ in myAccount. We will work out the tax credits that you can claim.

TTEC’s employer registration number

TTEC Customer Care Ireland: 8255172A

View your Tax Credit Certificate (TCC)

You will be able to view your TCC within two working days. To view your TCC, click on the ‘Manage your tax’ link in ‘PAYE Services’ in myAccount. An employer copy showing your total tax credits and rate bands will be made available to by TTEC. TTEC can then make the correct tax deductions from your pay.

How your tax is calculated

TTEC will be sent a Revenue Payroll Notification (RPN). After its received TTEC can calculate the correct deductions of:

- Income Tax (IT)

- Universal Social Charge (USC)

- Pay Related Social Insurance (PRSI)

Income Tax (IT)

Your IT is calculated on your ‘taxable pay’. This is the amount you earn after pension and permanent health insurance contributions are deducted. You pay IT at the standard rate of tax (20%), up to the amount of your standard rate band for that pay period. Any income above your standard rate band is taxed at the higher rate of tax (40%). These two amounts are added together to give your ‘gross Income Tax’. This figure is then reduced by your tax credits to give the amount of tax that you will pay. There are examples of how IT is calculated in Calculating your Income Tax. To make sure that you do not pay too much or too little IT, always check that your tax credits are correct.

USC

This charge is in addition to IT. USC deductions depend on the USC thresholds and rates that apply to you. There are examples of how USC is calculated under Calculating your USC.

PRSI

This charge is in addition to IT. PRSI deductions depend on your PRSI class. For more information, see the Department of Employment Affairs and Social Protection (DEASP) website.

Join us and thrive

Your next opportunity starts here. Whether you're actively searching or simply exploring what’s next. our Talent Community connects you with opportunities that align with your goals.